To figure out your marketing ROI, the simplest way is to use this formula: (Revenue from Campaign – Marketing Cost) / Marketing Cost × 100. This calculation gives you a straightforward percentage, showing you exactly how much you earned for every dollar you put in. Getting this basic calculation down is the essential first step to proving marketing’s real value.

Why Marketing ROI Matters More Than Ever

Let's cut to the chase. Proving the value of your marketing isn’t just a nice-to-have—it’s about survival. When you can confidently calculate and present your marketing ROI, you stop being seen as a cost center and start being recognized as a genuine revenue driver. That shift is everything when it comes to getting the C-suite's trust and the budget you need to make a real impact.

Think of solid ROI data as your best friend in the boardroom. It helps you:

- Justify Bigger Budgets: Nothing argues for more resources like hard data showing that your campaigns are already making money.

- Earn Executive Buy-In: When you connect marketing activities directly to revenue and profit, you're speaking the language of leadership.

- Sharpen Your Strategy: You can clearly see which channels are hitting it out of the park and which ones are duds, letting you double down on what works.

- Build a Data-First Culture: It moves your team away from "I think this will work" to "I know this works, and here's the proof."

The Foundation of ROI Calculation

At its heart, understanding marketing ROI starts with a simple formula. This classic approach of comparing money spent to money earned is the go-to for 35% of high-performing companies that consistently track their return. Its use really took off in the early 2010s as tracking tools became more accessible, making it easier than ever to connect specific campaigns to sales.

To really nail this, you need to be crystal clear on what goes into the formula. I've broken down the three core components for you here.

Breaking Down the Basic Marketing ROI Formula

This table defines the three essential variables you'll need for a straightforward marketing ROI calculation.

| Component | What It Means | Example |

|---|---|---|

| Sales Growth | The total increase in revenue directly tied to your marketing campaign. | $50,000 in new sales from a specific PPC campaign. |

| Marketing Costs | The total amount spent to create and run the campaign. | $10,000 on ad spend, creative, and software. |

| Marketing ROI (%) | The final percentage representing the return on your marketing investment. | 400% ROI, meaning you earned $4 for every $1 spent. |

Once you're comfortable with these basics, you can start digging into more nuanced calculations. But without a firm grasp of these three inputs, any advanced analysis will be built on a shaky foundation.

Key Takeaway: Tracking ROI isn't just about reporting on the past. It’s a strategic discipline that guides future investment and proves marketing's direct contribution to business growth.

Setting clear expectations from the outset is also a huge piece of the puzzle. Before you even think about launching a campaign, you need to align your efforts with specific, measurable outcomes. You can find some great ideas in this guide on powerful marketing goals examples to make sure you're set up for success from day one.

For those looking to go even deeper, especially on the advertising side, exploring resources on Mastering Advertising Effectiveness Measurement can provide a more granular view of campaign performance.

Gathering the Right Data for an Accurate Calculation

Any formula is only as good as the numbers you plug into it. To really get a grip on your marketing ROI, you have to become a bit of a detective, tracking down every single cost and revenue stream tied to your campaign. The old saying "garbage in, garbage out" has never been more true—if your data is incomplete, your final ROI percentage will be misleading at best.

The whole process kicks off with a thorough audit of your marketing expenses. It's pretty easy to remember the big-ticket items, but it's the smaller, often overlooked costs that can really throw off your final numbers.

Identifying Every Marketing Cost

Your total marketing investment is so much more than just what you spent on ads. A truly accurate calculation means you have to account for both the direct and indirect costs that went into a campaign. Forgetting these will artificially inflate your ROI and give you a false sense of success.

Let's break down the two main buckets of expenses you need to track.

Direct Costs: These are the straightforward expenses tied directly to a specific marketing campaign. Think of them as the ingredients in your marketing recipe.

- Ad Spend: The money you paid directly to platforms like Google, Meta, or LinkedIn to run your ads.

- Content & Creative Production: What you paid freelancers, agencies, or contractors for writing, design, video editing, or other creative assets.

- Promotional Expenses: The cost of any discounts, giveaways, or special offers you used to get people to convert.

- Event Costs: If your campaign involved a webinar or in-person event, this includes platform fees, speaker fees, venue rentals, and so on.

Indirect Costs: These are the ongoing operational expenses that keep your marketing engine running but aren't necessarily tied to just one campaign. This is the cost of your marketing "kitchen," not just the ingredients.

- Salaries & Labor: A portion of the salaries for the marketing team members who planned, executed, and managed the campaign.

- Software & Tools: The subscription costs for your marketing automation platform, analytics tools, SEO software, and social media schedulers.

- Overhead: A small fraction of general business costs, like office space or utilities, that can be allocated to the marketing department.

I see this all the time: people only track ad spend. You've got to remember to factor in a prorated amount of your team's salary and software subscriptions for the time they spent on the campaign. This gives you a much more realistic picture of your true investment.

Attributing Revenue Accurately

Once you've got a handle on all your costs, the next big challenge is connecting sales directly back to your marketing efforts. This is where attribution becomes absolutely critical. If you don't have a reliable way to link revenue to a specific campaign, you're just guessing about your impact.

Luckily, you have a few powerful tools at your disposal to make that connection crystal clear.

- UTM Parameters: These are simple tags you add to your URLs that tell your analytics software exactly where a visitor came from. You can instantly see if a sale originated from an email newsletter, a specific Facebook ad, or a guest blog post.

- Unique Discount Codes: Create campaign-specific promo codes (like "PODCAST20"). Every time that code is used at checkout, you can attribute the sale directly to your podcast advertising campaign. No guesswork involved.

- Dedicated Landing Pages: Send traffic from a specific campaign to a unique landing page that isn't indexed on your main site. All conversions that happen on that page get credited to that one initiative.

- CRM Tracking: Make sure your sales team is logging the lead source in your CRM. When a lead eventually becomes a customer, you can trace that revenue all the way back to the marketing touchpoint that first brought them in. Seamlessly integrating marketing automation with your CRM is the key to making this process work without a ton of manual data entry.

Let's see how this all comes together with a real-world example.

Scenario: “SoleMate Shoes” Influencer Campaign

Imagine an e-commerce brand, SoleMate Shoes, runs a month-long Instagram influencer campaign. To calculate their ROI, they first need to pull together all the relevant data.

| Data Point | Category | Amount | Notes |

|---|---|---|---|

| Influencer Payments | Direct Cost | $5,000 | Paid to three influencers for posts and Stories. |

| Product Samples Sent | Direct Cost | $500 | Cost of goods for the shoes sent to influencers. |

| Marketing Team Salary | Indirect Cost | $1,000 | Prorated salary for the manager running the campaign. |

| Social Media Tool | Indirect Cost | $50 | Prorated monthly fee for their scheduling software. |

| Total Marketing Costs | Total | $6,550 | This is the "M" in your ROI formula. |

| Revenue from Promo Code | Revenue | $22,000 | Tracked via the "INFLUENCER15" discount code. |

With these numbers, SoleMate Shoes has a clean and accurate dataset. They know their total investment was $6,550 and the campaign generated $22,000 in direct revenue. Now they have reliable inputs to plug into the ROI formula and get a result they can actually trust.

Choosing the Right Marketing ROI Formula

Let's be honest: not all marketing ROI calculations are created equal. The formula you pick can either give you a crystal-clear picture of your performance or completely muddy the waters. The right choice really comes down to what you're trying to measure. Are you after a quick gut-check on a campaign's profitability, or are you trying to understand the long-term health of your marketing engine?

A simple formula is great for a snapshot, but to really get to the truth of your profitability, you'll need something more detailed. Let's walk through three essential formulas I've used time and again, each designed for a different type of business and a different strategic question.

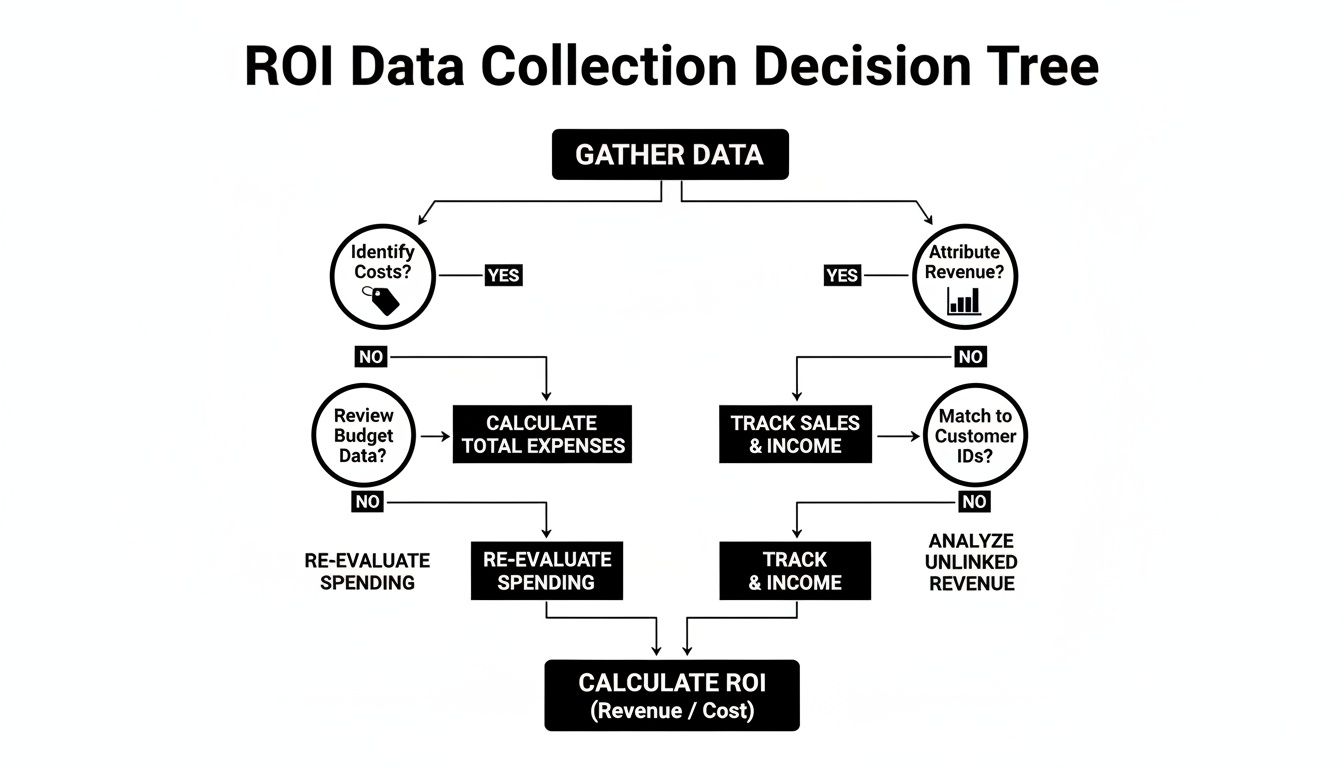

But before we even get to the math, you need a solid process for gathering your data. Think of it like a decision tree: you have to cleanly separate your costs from your revenue before you can calculate anything meaningful.

As this flowchart shows, getting your inputs right is the first—and most critical—step. Garbage in, garbage out.

The Simple ROI Formula: Your Go-To for Quick Assessments

This is the classic, back-of-the-napkin calculation and the one most marketers start with. It’s perfect for getting a fast, high-level read on a campaign's direct financial impact without getting lost in the weeds of complex accounting.

The Formula: (Revenue from Campaign - Marketing Cost) / Marketing Cost × 100

This gives you a straightforward percentage showing how much you earned for every dollar you spent. It works best for campaigns with easily traceable revenue, like a PPC or a targeted social media ad campaign.

Let's see it in action: A local bakery's Facebook campaign.

Imagine a small bakery spends $1,000 on Facebook ads to promote a new line of seasonal cupcakes. By using a unique discount code in the ad, they can track $4,500 in sales that came directly from that campaign.

- Marketing Cost: $1,000

- Revenue Generated: $4,500

Plugging those numbers in: ($4,500 - $1,000) / $1,000 × 100 = 350%

A 350% ROI is fantastic. It tells the bakery owner that for every dollar they put into those ads, they got $3.50 back in profit—before accounting for the cost of flour, sugar, and everything else.

The Gross Profit Formula: A Reality Check for Product Businesses

While simple ROI is a great starting point, it can be dangerously misleading if you sell physical products. Why? Because it completely ignores the cost of making or buying the stuff you sold! This is where the Gross Profit ROI formula comes in to give you a much more honest look at your real profitability.

The Formula: (Gross Profit - Marketing Investment) / Marketing Investment × 100

Here's a real-world example: An e-commerce sneaker brand.

Let's say an online sneaker store spends $10,000 on a Google Shopping campaign. The campaign drives an impressive $50,000 in revenue. But here’s the catch: the Cost of Goods Sold (COGS)—what it actually cost to manufacture and ship those sneakers—was $25,000.

- Gross Profit: $50,000 (Revenue) – $25,000 (COGS) = $25,000

- Marketing Investment: $10,000

Now, let's use the right formula: ($25,000 - $10,000) / $10,000 × 100 = 150%

That 150% ROI is the real number. A simple ROI calculation would have shown a whopping 400% return, but this more accurate figure proves the campaign was truly profitable after all costs were considered.

The CLV-Based Formula: Thinking Beyond the First Sale

For subscription businesses, SaaS companies, or any brand that relies on repeat customers, judging a campaign on the first transaction is incredibly short-sighted. An initiative might look like a flop initially but turn out to be a goldmine over the long run. This is where Customer Lifetime Value (CLV) becomes your best friend.

The Formula: (Customer Lifetime Value × New Customers - Marketing Investment) / Marketing Investment × 100

This approach rightly shifts your focus from short-term cash grabs to long-term, sustainable growth. It helps you justify what might seem like a high cost to acquire a customer upfront.

A perfect scenario: A B2B SaaS company's content marketing push.

A SaaS firm invests $20,000 in a content marketing campaign (webinars, gated guides) to attract sign-ups for its $50/month plan. The campaign successfully brings in 40 new customers.

If you only look at the first month, the numbers are grim: (40 customers × $50) - $20,000 = -$18,000. Looks like a total failure, right?

But wait. The company knows from its data that the average customer sticks around for 36 months.

- Customer Lifetime Value (CLV): $50/month × 36 months = $1,800

- Total Lifetime Revenue from Campaign: 40 customers × $1,800 = $72,000

- Marketing Investment: $20,000

Let’s recalculate with the CLV-based formula: ($72,000 - $20,000) / $20,000 × 100 = 260%

Now that's a different story. The CLV-based ROI of 260% shows the campaign was actually a massive long-term success. This is proof that investing in acquiring the right customers—the ones who stick around—is far more valuable than just chasing cheap, one-off conversions.

To help you decide which formula fits your needs, here's a quick comparison of the three main models.

Comparing ROI Calculation Models

| Formula Type | Best For | Key Benefit | Potential Limitation |

|---|---|---|---|

| Simple ROI | Quick campaign analysis, digital marketing, service-based businesses. | Easy and fast to calculate, providing a clear top-line performance metric. | Ignores product costs (COGS), which can inflate profitability figures. |

| Gross Profit ROI | E-commerce, retail, and any business selling physical products. | Gives a true picture of campaign profitability by including product costs. | Requires accurate COGS data, which can be complex to track per campaign. |

| CLV-Based ROI | SaaS, subscription services, and businesses focused on repeat customers. | Measures long-term value and justifies higher customer acquisition costs. | Relies on predictive CLV models, which may not be 100% accurate. |

Each of these formulas tells a different part of your marketing story. The key is to pick the one that aligns with your business model and gives you the insights you need to make smarter decisions.

And remember, you can also turn these ROI principles into a powerful lead generation tool. Many B2B companies have seen great success by building an ROI calculator that allows prospects to plug in their own numbers and see the potential value of a product or service firsthand.

Thinking Beyond Basic ROI with LTV and Attribution

A simple ROI calculation gives you a snapshot, but it often misses the bigger story. Relying on it exclusively is a bit like judging a movie by its opening scene—you get a piece of the action, but you miss all the character development and the finale.

To really get an accurate picture of your marketing ROI, you have to look beyond a single purchase. It's about understanding the entire customer journey and what that customer is worth to you over the long haul. This is where we need to talk about marketing attribution and Customer Lifetime Value (LTV).

The Problem with Last-Touch Attribution

Most marketers, especially when they're starting out, fall back on last-touch attribution. This model is straightforward: it gives 100% of the credit for a sale to the very last thing a customer interacted with before buying. If they clicked a Google Ad and then purchased, Google Ads gets all the glory.

But is it really that simple? Almost never.

A customer’s path to purchase is usually a winding road. They might have first discovered your brand six weeks ago from a blog post, followed you on social media, saw a retargeting ad, and then finally clicked that search ad. Last-touch attribution completely ignores the critical groundwork laid by the blog and social channels.

Over-relying on last-touch attribution is a classic mistake that leads to bad budget decisions. You might slash funding for top-of-funnel activities like content marketing because they don't look like they're driving sales directly. In reality, you could be killing the very engine that warms up your future customers.

Embracing a Multi-Touch Perspective

To get a more realistic view, you need to look at multi-touch attribution models. These models are designed to distribute credit for a conversion across the various touchpoints that influenced the customer.

Here are a few common models I've seen work well:

- Linear: This one’s the simplest. It gives equal credit to every single touchpoint. It’s a great starting point for acknowledging that every interaction played some part.

- Time-Decay: Here, the touchpoints closer to the sale get more credit. This makes a lot of sense for businesses with longer sales cycles, where the most recent interactions are often the most influential.

- U-Shaped: This model gives the most credit to the very first touch (what introduced the customer) and the very last touch (what sealed the deal), usually assigning 40% to each. The remaining 20% gets split among all the interactions in the middle.

There's no single "right" model—it really depends on your business and how your customers buy. The key is to move past a single-point perspective and recognize that marketing channels work together to score a goal.

The Power of Customer Lifetime Value in ROI

Just as attribution gives you a clearer view of the journey, Customer Lifetime Value (LTV) gives you a more strategic view of revenue. Calculating ROI based on just the first purchase can be incredibly misleading, especially if your business relies on repeat customers.

Think about it: a campaign might actually lose money on the first sale. But if it brings in customers who stick around for years and make multiple purchases, that campaign could be a massive long-term winner. This is why the LTV-to-CAC (Customer Acquisition Cost) ratio is such a vital health metric for any business.

For most businesses, a healthy LTV:CAC ratio is 3:1 or better. This means for every dollar you spend to acquire a customer, they generate at least three dollars in value over their lifetime.

Tying It All Together with LTV-Based ROI

Let's walk through a real-world scenario. Imagine a SaaS company spends $30,000 on a campaign and acquires 50 new customers for its $100/month plan.

- First-Month ROI: Looking at just the first month, the math is

(50 customers * $100) - $30,000 = -$25,000. On paper, this looks like a total disaster.

But this company has done its homework and knows its average customer stays for 24 months.

- Customer Lifetime Value (LTV): $100/month × 24 months = $2,400

- Total Lifetime Revenue from Campaign: 50 customers × $2,400 = $120,000

Now, let's run that ROI calculation again, but this time with the full picture in mind. The formula for LTV-based ROI is: (LTV × New Customers – Marketing Investment) / Marketing Investment × 100.

- LTV-Based ROI:

($120,000 - $30,000) / $30,000 * 100 = 300%

Suddenly, that "failed" campaign is a 300% ROI home run. This shift in perspective proves that focusing on acquiring high-value, long-term customers is what truly matters. If you're looking to improve this metric, our guide on how to increase customer lifetime value has some great, actionable strategies.

By moving your focus from a single transaction to the entire customer relationship, you unlock a much more powerful and accurate way to measure what your marketing is actually worth.

Common ROI Calculation Mistakes and How to Avoid Them

Calculating marketing ROI can feel like navigating a minefield. Even when you have the right formulas, it's the small missteps that lead to big inaccuracies, giving you a completely skewed picture of what’s actually working. I’ve seen it happen time and again. To get this right, you have to sidestep the common traps that snag even experienced marketers.

One of the most frequent errors I see is an incomplete accounting of costs. It's so easy to just tally up the obvious ad spend. But what about the prorated salaries of your marketing team who spent hours on that campaign? Or the subscription fees for the analytics, design, and automation software you couldn't have done the work without?

Forgetting these "soft costs" will artificially inflate your ROI. It can make a decent campaign look like a runaway success. A simple fix is to create a checklist of every potential expense before a campaign even kicks off. Think tools, team time, creative, and overhead.

Forgetting to Account for Organic Sales

This one is a classic. It’s when marketing takes credit for sales that were going to happen anyway. Picture this: a customer is already heading to your checkout page, fully intending to buy. Just then, they see one of your retargeting ads, click it out of habit, and complete the purchase. Under a last-touch attribution model, that ad just got 100% of the credit.

That’s called cannibalization—your marketing isn't creating new demand, it's just intercepting demand that already existed.

To get a truer picture, you need to be a bit more thoughtful:

- Establish a Baseline: Before you launch anything, get a clear read on your typical organic sales rate. The genuine impact of your campaign is the lift you see above that baseline.

- Use Control Groups: This is the gold standard. If you can, serve your campaign to one audience segment while holding back a similar control group. The difference in sales between the two is your actual incremental lift.

Key Insight: The real goal isn't just to count all sales that happened during a campaign. It’s to measure the additional sales that happened because of the campaign. That crucial distinction is the heart of an honest ROI calculation.

Focusing Only on Short-Term Gains

Another major pitfall is an obsession with immediate returns. A campaign might show a weak ROI in its first 30 days but could be quietly building brand awareness that pays off for months or even years. Content marketing is the perfect example; a single blog post rarely drives a sale on day one, but it can build immense trust and attract high-quality customers six months down the line.

Chasing those quick, short-term wins can lead you down a dangerous path of prioritizing high-pressure tactics over building a genuinely loyal customer base. The solution is to balance your analysis by tracking long-term metrics alongside your immediate sales figures.

Look at things like:

- Brand Mentions: Are more people talking about you online?

- Organic Traffic Growth: Are you seeing a steady climb in direct and search traffic over time?

- Lead Quality: Are the leads from this campaign eventually turning into your best customers?

Ultimately, a robust understanding of how to calculate marketing ROI means looking at both the immediate transaction and the long-term brand equity you’re building. Avoiding these common mistakes will ensure your numbers tell the true, complete story of the value your marketing delivers.

Answering Your Toughest Marketing ROI Questions

Once you start digging into the numbers, you'll quickly find that real-world marketing doesn't always fit neatly into a formula. What about salaries? When is the right time to measure? And what does a "good" ROI even look like?

Let's tackle some of the most common questions that come up when marketers start getting serious about ROI. These are the practical, in-the-weeds issues that can make or break your analysis.

What Is a Good Marketing ROI?

This is the question everyone asks, and the honest answer is, "it depends." There's no magic number that works for every business. A good ROI is deeply connected to your industry, profit margins, and the overall financial health of your company.

Think about it this way: an e-commerce store with thin margins might need a 5:1 ratio (a 500% return) just to stay in the black after accounting for the cost of goods sold. On the other hand, a high-margin B2B software company could be wildly successful with a 3:1 ratio (300%), especially if they have a long customer lifetime value.

A 5:1 ratio is often thrown around as a general benchmark, meaning for every $1 you spend, you get $5 back. But the most important benchmark is your own. Your goal should be to constantly improve on your past performance.

How Long Should I Wait to Measure ROI?

Patience is a virtue here. Measuring ROI too soon is a classic mistake that can make a winning campaign look like a total flop. The right time frame is dictated entirely by your sales cycle.

- Short Sales Cycles (E-commerce, B2C): If your customers typically buy within a few days or weeks, you can get a pretty clear picture within 30 to 60 days.

- Long Sales Cycles (B2B, High-Ticket Items): For businesses with a sales process that spans several months, you need to match your measurement window accordingly. If your average sale takes six months to close, measuring after just 30 days will tell you nothing. You have to give the leads time to mature.

Should I Include Salaries in My Marketing Costs?

Yes, you absolutely should. This is probably the single most common oversight people make, and it will dramatically inflate your ROI, giving you a false sense of success.

Your team's time is one of your biggest investments. A simple way to account for it is to estimate what percentage of their time was dedicated to a specific campaign and then allocate a portion of their salary to that cost. Including these "soft costs," alongside things like agency fees and software subscriptions, gives you a true understanding of a campaign's profitability.

At Sugar Pixels, we believe proving marketing's value shouldn't be a guessing game. We build performance-driven websites and manage digital marketing campaigns that are all about delivering clear, measurable results. We're here to help you turn your marketing into a powerful engine for business growth. Learn how we can help you track and improve your ROI at https://www.sugarpixels.com.